Homeowners Insurance in and around Springfield

Looking for homeowners insurance in Springfield?

Apply for homeowners insurance with State Farm

Would you like to create a personalized homeowners quote?

Home Sweet Home Starts With State Farm

Everyone knows having fantastic home insurance is essential in case of a fire, tornado or ice storm. But homeowners insurance is about more than covering natural disaster damage. Another helpful thing about home insurance is that it also covers you in certain legal cases. If someone trips due to your careless error, you could be required to pay for their hospital bills or their lost wages. With adequate home coverage, your insurance may cover those costs.

Looking for homeowners insurance in Springfield?

Apply for homeowners insurance with State Farm

Why Homeowners In Springfield Choose State Farm

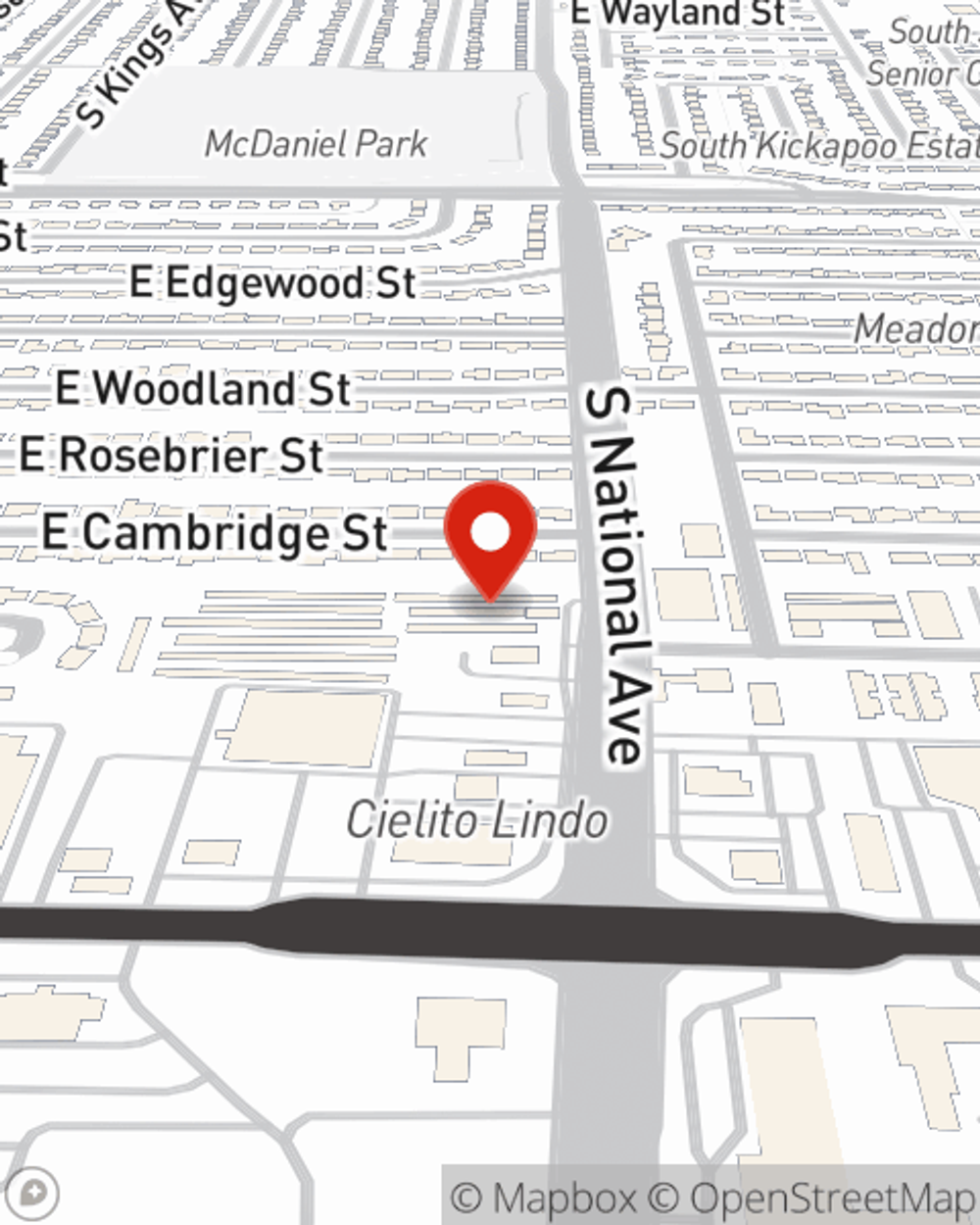

Homeowners coverage like this is what sets State Farm apart from the rest. Agent Lance Haight can be there whenever you have problems at home, to get your homelife back to normal. State Farm is there for you.

So visit agent Lance Haight's team for more information on State Farm's exceptional options for protecting your home and belongings.

Have More Questions About Homeowners Insurance?

Call Lance at (417) 881-2086 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

What is individual liability insurance and what does it cover?

What is individual liability insurance and what does it cover?

Liability insurance is typically a portion of the coverage for a home or vehicle policy. A Personal Liability Umbrella Policy may be another viable option for further protection.

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.

Lance Haight

State Farm® Insurance AgentSimple Insights®

What is individual liability insurance and what does it cover?

What is individual liability insurance and what does it cover?

Liability insurance is typically a portion of the coverage for a home or vehicle policy. A Personal Liability Umbrella Policy may be another viable option for further protection.

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.